If your company is located in the state of New Jersey or if your employees work in New Jersey, then be sure to follow these instructions in order to properly set up the Payroll system.

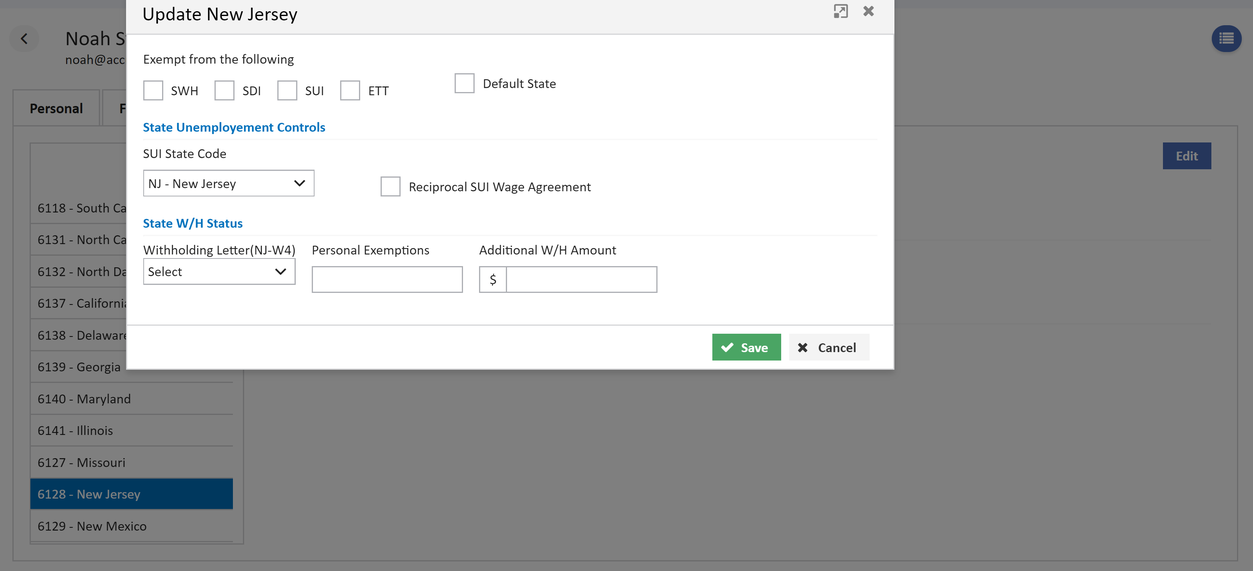

- Employee Information - On Employees Details > States > Add State, select the New Jersey state code. Using the information from the New Jersey Employee Tax Withholding Certificate (Form NJ-W4), fill in the employee's tax letter and dependent exemption information.

- Payroll Processing - When the payroll taxes are calculated for New Jersey, the withholding tax is calculated based on the tax letter and dependent exemptions as set up in the employee file.

Click Here to download User Guide

Click Here to download User Guide